When you're on Medicare Part D, the federal program that helps pay for prescription drugs for people enrolled in Medicare. Also known as Medicare prescription drug coverage, it's not automatic—you have to choose a plan, and the wrong choice can cost you hundreds or even thousands a year. This isn’t just about getting your pills covered. It’s about understanding deductibles, copays, coverage gaps, and which drugs are actually on your plan’s list.

Many people think all Medicare plans are the same, but Medicare Part D plans vary wildly. One plan might cover your blood pressure med at $5 a month, while another charges $45. Some have no deductible, others have a $500 one. And then there’s the coverage gap—also called the donut hole. Once you and your plan spend a certain amount, you pay more out of pocket until you hit the catastrophic threshold. In 2024, you enter the gap after spending $5,030 on covered drugs. You don’t pay 100% though—thanks to recent law changes, you only pay 25% of the cost for brand-name and generic drugs while in the gap.

It’s not just about price. Formularies matter. That’s the list of drugs your plan covers. If your doctor prescribes a drug not on the list, you might pay full price or need a prior authorization. Some plans require step therapy—you have to try a cheaper drug first before they’ll pay for the one your doctor picked. And don’t forget: if you don’t sign up when you’re first eligible, you could pay a late enrollment penalty forever. It’s 1% of the national base beneficiary premium for every month you delay, added to your monthly bill.

People on Medicare Part D often take multiple medications. That’s why so many of the posts here focus on drug interactions, storage, and alternatives. If you’re on ramipril, you need to watch your salt. If you’re on amitriptyline, you might be at higher risk for falls. If you’re taking calcium and a bisphosphonate, timing matters. Medicare Part D doesn’t just pay for the pills—it’s your gateway to understanding how those pills affect your whole body.

You’ll find guides here on generic drugs, how to save money on prescriptions, how to avoid dangerous combinations, and how to organize your meds safely at home. These aren’t random articles. They’re the real-world tools you need if you’re managing chronic conditions, juggling multiple prescriptions, or trying to stretch a fixed income. Whether you’re helping a parent navigate their first Medicare year or figuring out your own coverage, the goal is the same: avoid overpaying, stay safe, and keep your meds working the way they should.

Understand how 2025 Medicare Part D formulary updates are forcing generic and biosimilar switches, what drugs are affected, and how to protect your coverage before January 1.

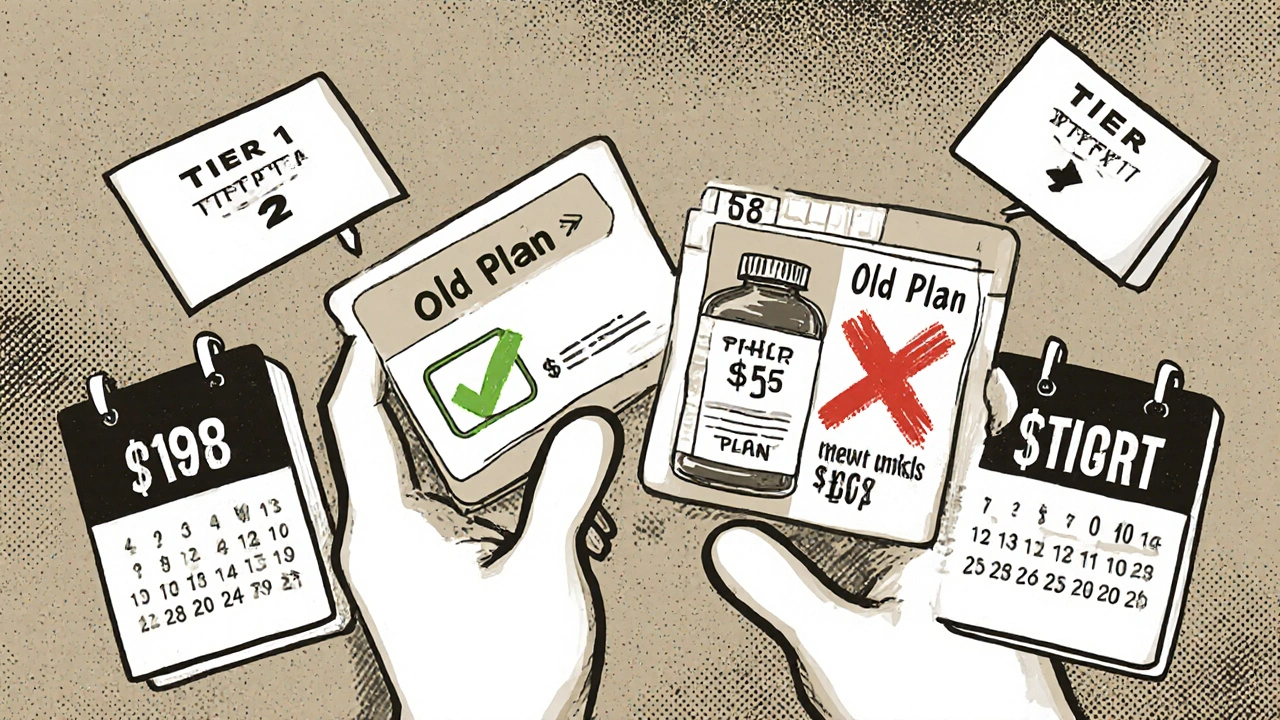

When switching health plans, your generic drug coverage can save or cost you hundreds a year. Learn how formulary tiers, deductibles, and state rules impact your prescription costs-and how to avoid expensive surprises.

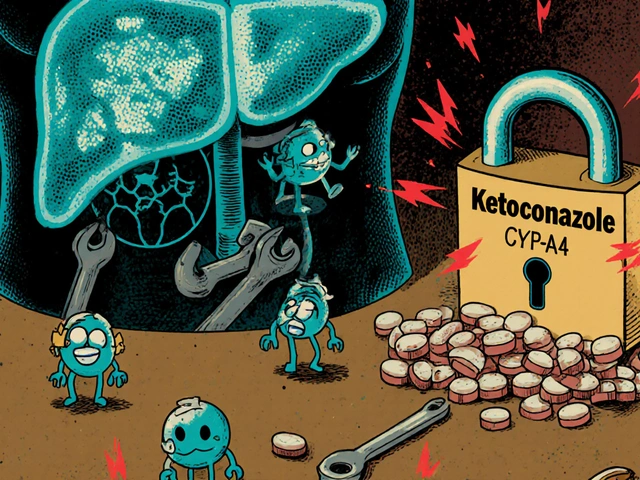

Drug-drug interactions can cause serious harm when medications clash in your body. Learn how liver enzymes, transporters, and genetics affect drug safety, and what you can do to avoid dangerous combinations.

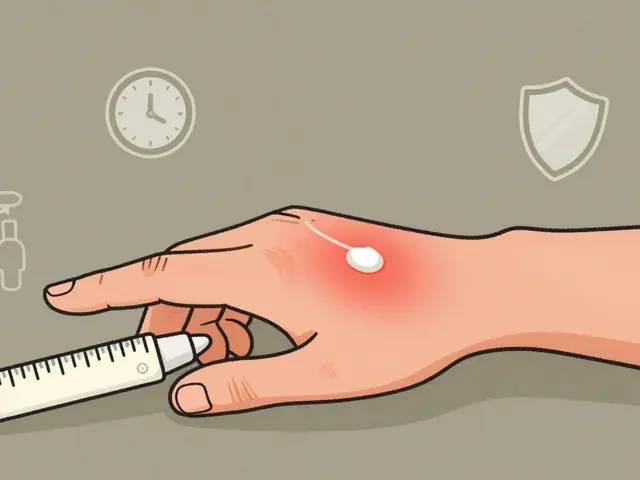

Topical steroids treat eczema and psoriasis effectively but can cause skin thinning if misused. Learn how to use them safely with the right dose, duration, and strength to avoid permanent damage.

Learn how drug take-back programs safely dispose of unused medications through permanent drop boxes, mail-back envelopes, and nationwide events. Find out what you can and can’t dispose of, and how to locate the nearest collection site.

Learn how to stay informed about FDA drug recalls and safety alerts. Get practical steps to sign up for alerts, report side effects, and protect yourself from dangerous medications.

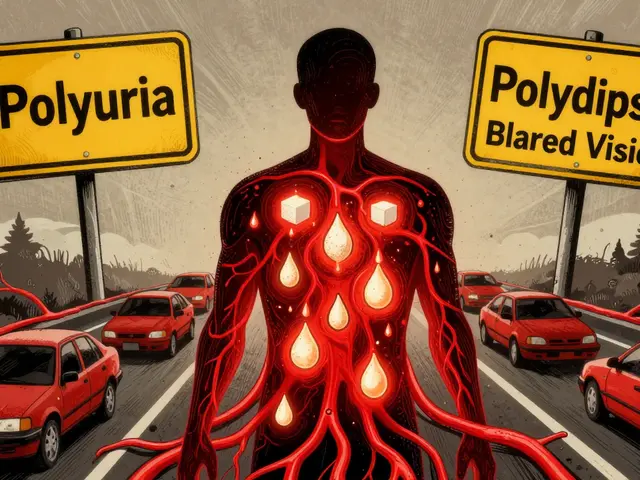

Learn the early and emergency symptoms of hyperglycemia, how to tell the difference between DKA and HHS, and what steps to take when blood sugar spikes dangerously high. This guide gives clear, actionable advice for managing high blood sugar before it becomes life-threatening.