When you pick up a prescription, the price you pay isn’t just set by the drug company—it’s shaped by your insurance plan’s formulary tiers, a system that groups medications into cost levels based on price, effectiveness, and negotiation deals. Also known as drug formulary, it’s how pharmacies and insurers decide what you pay out-of-pocket for each pill or injection. You might not see it, but every time you swipe your card at the pharmacy, you’re hitting one of these tiers.

Most plans use four to five tiers. Tier 1 is usually generic drugs—cheap, effective, and preferred by insurers. Tier 2 is brand-name drugs with generic alternatives available. Tier 3 is higher-cost brand-name meds with no cheap version. Tier 4? That’s for specialty drugs, like those for cancer or MS, which can cost hundreds or even thousands per month. Some plans even have Tier 5 for the most expensive treatments. The kicker? The higher the tier, the more you pay. It’s not random—it’s designed to push you toward cheaper options. Insurers negotiate deals with drug makers to get lower prices on meds in lower tiers, then pass some of those savings to you. But if you pick a drug on Tier 4 or 5, you’re often stuck paying more unless you appeal or switch.

This system ties directly to how pharmacy benefit managers, companies that manage drug coverage for insurers and employers. Also known as PBMs, they decide which drugs go where on the formulary. They don’t just pick based on safety—they pick based on cost, rebates, and contracts. That’s why two plans with the same insurer might list different drugs on Tier 1. It’s also why some drugs you’ve used for years suddenly jump to a higher tier. You’re not imagining it. The formulary changed.

And it’s not just about price. Formulary tiers affect what your doctor prescribes. If your doctor wants to give you a brand-name drug on Tier 3, they might need prior authorization—meaning the insurer has to approve it before you get it. Sometimes, they’ll ask you to try a cheaper generic first. That’s called step therapy. It’s legal, common, and often frustrating. But knowing how tiers work lets you ask the right questions: Is there a generic? Can we try a Tier 1 alternative? What’s the cost difference?

What you’ll find below are real, practical guides that break down how this system impacts your daily life. You’ll read about how generic drugs get approved and priced, how to avoid absorption problems with common meds like calcium and bisphosphonates, and why some drugs like ramipril or tolvaptan come with strict diet rules. You’ll see how insurance formularies shape choices for everything from antidepressants to erectile dysfunction pills. These aren’t theoretical—they’re based on how real people navigate prescriptions, copays, and surprise bills.

When switching health plans, your generic drug coverage can save or cost you hundreds a year. Learn how formulary tiers, deductibles, and state rules impact your prescription costs-and how to avoid expensive surprises.

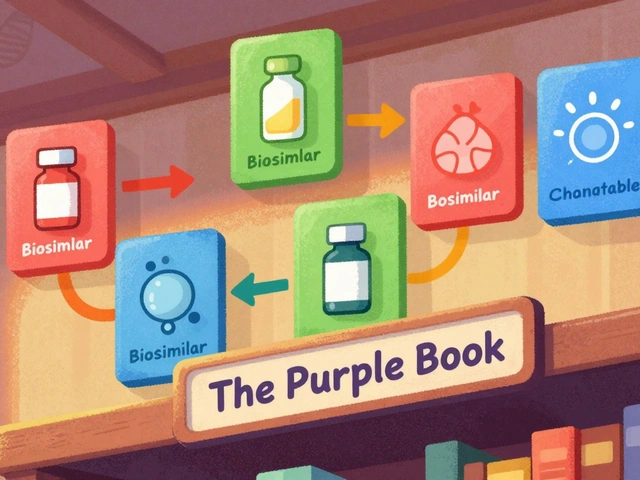

The FDA's Purple Book is the official guide to biosimilars and interchangeable biological drugs. Learn how it works, what the difference is between biosimilars and interchangeable products, and how pharmacists use it to make safe substitutions.

Tired of Pharmex Direct or just curious about what else is out there? This article unpacks the best alternatives for Canadians looking for reliable pharmacy options. From big-brand stores to convenient online choices, get the details on pricing, services, and trustworthiness. For anyone who wants straightforward pharmacy solutions without the fuss, this will make picking your next pharmacy a whole lot easier.

Learn practical diet and nutrition strategies to keep estradiol levels balanced, covering phytoestrogens, omega‑3s, vitamin D, fiber and more.

Medicare Part D saves billions by prioritizing generics. This article explains how formulary tiers, recent laws, and plan choices impact prescription costs. Learn real-world savings examples and practical steps to maximize benefits.

Most people don't tell their doctors about dietary supplements-even though they can interact dangerously with medications. Learn why full disclosure matters, which supplements are riskiest, and how to talk to your care team safely.