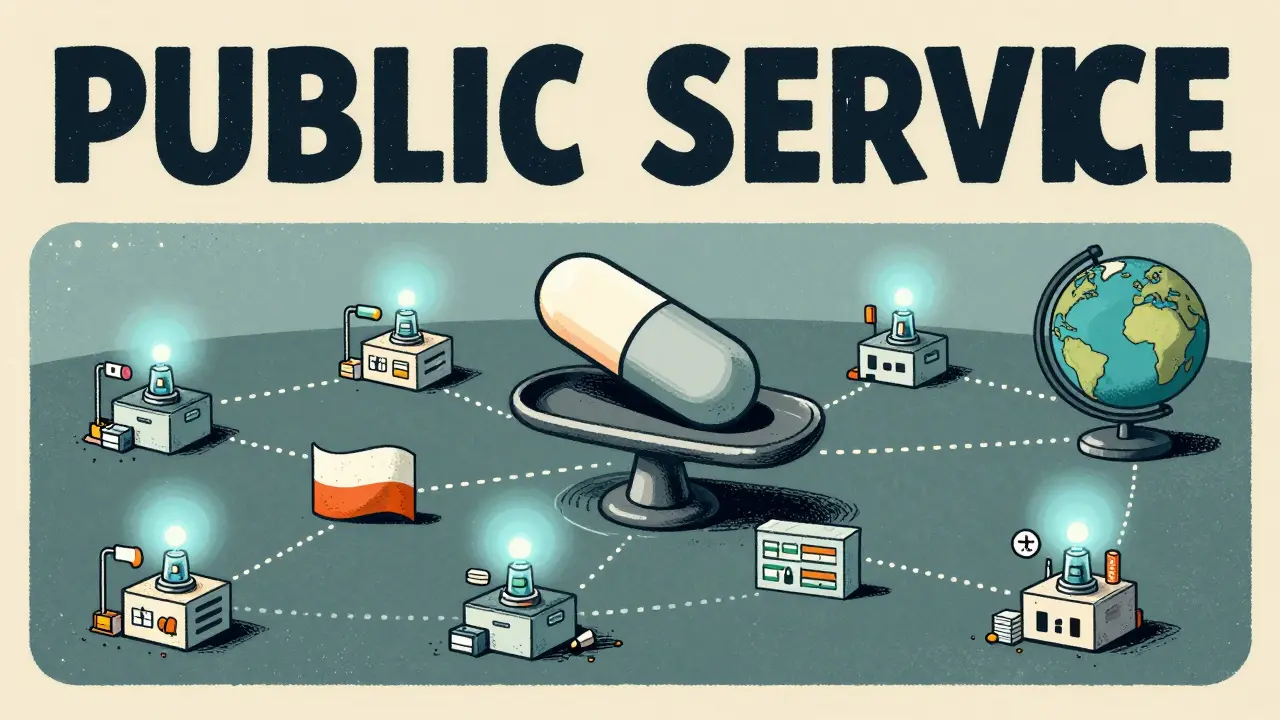

When you walk into a pharmacy and your prescription isn’t in stock, it’s easy to blame the pharmacist. But the real issue is often thousands of miles away-in a factory in China, India, or another country that makes the raw ingredients for your medicine. By 2025, foreign manufacturing accounts for over 80% of active pharmaceutical ingredients (APIs) used in U.S. and European drugs. That’s not a backup plan. It’s the main system. And when that system stumbles, people don’t get their medication.

How We Got Here

It wasn’t always this way. In the 1980s, most drugs sold in the U.S. were made domestically. But as companies chased lower costs, they began shifting production overseas. China and India became the go-to suppliers because they could produce APIs at a fraction of the price. A kilogram of penicillin that cost $200 to make in the U.S. could be made for $40 in China. That’s a 75% savings. For big drugmakers, that meant billions in profit. By 2025, the numbers are staggering: 97% of the world’s antibiotics, 85% of the world’s heparin, and 70% of the world’s ibuprofen come from just two countries. The World Bank reports that Asia now produces half of all global manufacturing output-and nearly two-thirds of that is pharmaceutical. This wasn’t a risky bet. It was a calculated move. And for decades, it worked.Why It’s Falling Apart

The problem isn’t just that we rely on foreign factories. It’s that we rely on too few of them. One single facility in China can supply 40% of the world’s heparin. One plant in India can make 80% of the raw material for blood pressure meds. When something goes wrong-like a factory shutdown due to a flood, a sudden export ban, or a customs delay-the ripple effect hits hospitals and pharmacies within weeks. In 2024, a fire at a Chinese API plant caused a global shortage of metformin, the most common diabetes drug. Patients in the U.S. and Europe waited months. Some switched to more expensive alternatives. Others skipped doses. The FDA confirmed over 200 drug shortages that year-more than any year since 2012. And 92% of those were tied directly to foreign manufacturing disruptions. Even small delays add up. The average lead time for a shipment of APIs from China to the U.S. has jumped 50% since 2019, according to CNBC. A container that used to take 20 days to cross the Pacific now takes 30. That’s not just a shipping delay. It’s a medical emergency waiting to happen.The Domino Effect on Drug Prices

When supply chains break, prices don’t just go up-they spiral. In 2025, the average cost of tariff-affected pharmaceutical ingredients rose 200-300% compared to pre-pandemic levels. That’s not because the cost of making the drug changed. It’s because companies had to scramble to find new suppliers, pay higher freight rates, or stockpile inventory just in case. One Fortune 500 medical device maker switched from relying solely on China to nearshoring production to Mexico. They saved 35% on shipping and cut lead times from 45 days to 18. But it cost them $2.3 million in new equipment and training. That’s not a small investment. And it’s not something small pharmacies or generic drugmakers can afford. As a result, the cheapest versions of life-saving drugs are disappearing. Generic insulin, which used to cost $20 a vial, now costs $45 in many places. The reason? The API for insulin is made in one region of India. When a labor strike hit that region in late 2024, production dropped 60%. No one else could make it fast enough.

What’s Being Done

Some companies are waking up. By 2025, 78% of pharmaceutical firms are using inventory buffers or dual-sourcing strategies-meaning they now buy critical ingredients from at least two different countries. That’s up from just 35% in 2020. One company, a U.S.-based maker of chemotherapy drugs, started sourcing key APIs from both India and Germany. When India’s export rules changed, they switched seamlessly to Germany. Their on-time delivery rate hit 99.2%. Governments are stepping in too. The U.S. passed the 2024 Drug Supply Chain Security Act, which requires companies to track every API from source to shelf. The EU launched the Pharmaceutical Strategy for Europe, aiming to bring back 20% of API production to the continent by 2030. And the renegotiated USMCA, updated in early 2025, now includes special provisions for pharmaceutical supply chains, making it easier for U.S. companies to source from Mexico without facing punitive tariffs. But these are slow fixes. Building a new API plant takes 3-5 years. Training workers takes another 1-2. And the cost? Up to 22% of a company’s annual procurement budget, according to Plante Moran’s 2025 analysis. That’s a huge barrier for smaller drugmakers.The Hidden Risks No One Talks About

Most people think the biggest threat is political tension or tariffs. But the real danger is quieter-and more systemic. Cyberattacks. Workforce shortages. Climate disasters. In 2024, a ransomware attack shut down a major API supplier in India for 11 days. No one knew until the hospitals started running out. That’s because most pharmaceutical supply chains still rely on fax machines and spreadsheets. Only 68% of manufacturers use AI for forecasting, and just 40% have digital twins to simulate disruptions before they happen. And the people who run these systems? They’re in short supply. In 2025, 33% of pharmaceutical companies reported being understaffed in global trade management. That means even when a backup supplier is ready, no one has time to verify the paperwork, test the batch, or get it through customs.

What This Means for You

If you take a daily medication-blood pressure pills, thyroid medicine, insulin, or even antibiotics-you’re already feeling the impact. The next time your pharmacy says, “We’re out of stock,” don’t assume it’s a temporary glitch. It’s a symptom of a broken global system. The truth is, we can’t go back to making everything at home. Wages in the U.S. are 4.8 times higher than in China for comparable manufacturing work, according to IMD Business School. That’s not sustainable. But we also can’t keep betting everything on one country. The solution isn’t reshoring. It’s rebalancing. Diversifying suppliers. Investing in digital tracking. Building local stockpiles for critical drugs. And demanding transparency from manufacturers. Some pharmacies are already doing this. In Brighton, a local chain started partnering with U.S.-based distributors who source APIs from multiple countries. They pay slightly more per pill-but they never run out. And their customers? They’re not scrambling to find alternatives during a shortage.The Future Is Distributed

The future of drug supply chains won’t be centralized. It won’t be in one country. It’ll be spread out-across North America, Europe, Southeast Asia, and Latin America. Microfactories powered by automation are starting to appear in Texas and Poland, making small batches of high-demand drugs on demand. These aren’t giant plants. They’re compact, flexible, and fast. One can produce a month’s supply of a drug in 72 hours. But they need investment. And policy support. And public pressure. Right now, the system is designed for efficiency. But efficiency without resilience is just a waiting game. And the next drug shortage could be worse than the last. The question isn’t whether we’ll face another shortage. It’s whether we’ll be ready when it happens.Why are most drugs made overseas?

Most drugs are made overseas because producing active pharmaceutical ingredients (APIs) in countries like China and India is significantly cheaper-up to 75% less than in the U.S. or EU. Lower labor costs, fewer environmental regulations, and government subsidies made these regions the most cost-effective option. Over time, drugmakers centralized production to maximize profits, and the global supply chain became heavily dependent on just a few suppliers.

How do supply chain issues cause drug shortages?

Drug shortages happen when a single factory or country that produces a key ingredient stops output due to natural disasters, political bans, labor strikes, or cyberattacks. Because many drugs rely on just one or two suppliers for their active ingredients, even a 10-day delay can cause a global ripple effect. It takes weeks to reroute shipments, test new batches, and get regulatory approval-time patients don’t have.

Is the U.S. trying to bring drug production back home?

The U.S. is not fully reshoring production because it’s too expensive. Instead, it’s pushing for "multi-shoring"-diversifying suppliers across multiple countries like Mexico, India, Germany, and Vietnam. The 2024 Drug Supply Chain Security Act and the updated USMCA are designed to make this easier by improving tracking, reducing tariffs on alternative sources, and incentivizing nearshoring. But full domestic production isn’t realistic for most drugs due to cost.

Can AI help fix drug supply chain problems?

Yes. AI is being used to predict disruptions, optimize inventory levels, and track shipments in real time. By 2025, 68% of large pharmaceutical companies use AI for supply chain forecasting-up from just 22% in 2020. AI can flag potential delays before they happen and suggest alternative suppliers automatically. But smaller manufacturers still struggle to afford the technology, creating a gap between big and small players.

What can patients do if their medication is unavailable?

If your medication is out of stock, talk to your doctor immediately. They may be able to prescribe an alternative with the same active ingredient or adjust your dosage. You can also check the FDA’s Drug Shortages database for updates. Some pharmacies now offer pre-order alerts for high-demand drugs. Avoid switching to unverified online sellers-many counterfeit drugs enter the market during shortages.

Are generic drugs more vulnerable to shortages than brand-name drugs?

Yes. Generic drugs are more vulnerable because they’re made by smaller companies with thinner profit margins. They often rely on a single supplier for APIs and can’t afford to stockpile inventory or diversify sourcing. Brand-name drugmakers, on the other hand, have bigger budgets, more suppliers, and better logistics systems. That’s why shortages hit generics like metformin, insulin, and antibiotics first-and hardest.

Gregory Parschauer

January 13, 2026 AT 21:40Let me get this straight-we’ve outsourced the very building blocks of human health to a regime that treats dissenters like lab rats? And now we’re shocked when the system collapses? This isn’t capitalism-it’s national suicide with a side of profit margins. We let China play Jenga with our medicine, and now we’re surprised the tower fell? Wake up. This was predictable. And it’s criminal.

Every time you take a pill made in a factory with no OSHA standards, you’re gambling your life on a spreadsheet. And who’s paying? The elderly. The diabetic. The cancer patient. Not the CEOs. Not the shareholders. YOU.

They call it 'globalization.' I call it surrender. We used to make penicillin in Ohio. Now we beg for it from a country that’s building missile silos while we beg for insulin. Pathetic.

And don’t give me that 'it’s cheaper' nonsense. How cheap is a dead grandparent? How cheap is a child with untreated asthma? You can’t price human dignity. But apparently, Wall Street can.

Until we start treating pharmaceuticals like critical infrastructure-not commodities-we’re all just waiting for the next shutdown. And the next one won’t be metformin. It’ll be epinephrine. Or insulin. Or antibiotics. And then? Good luck.

They told us this was efficiency. It’s not. It’s fragility dressed in a suit. And we’re the ones paying the piper.

Time to nationalize API production. Or at least tax the hell out of companies that outsource life-saving drugs. Because this isn’t business. It’s betrayal.

And yes, I’m angry. You should be too.

vishnu priyanka

January 15, 2026 AT 03:17Man, I see this every day in Hyderabad-factories humming, workers in blue uniforms, machines churning out APIs that end up in your medicine cabinet. We don’t make the final pills, but we make the soul of them. And yeah, we’re cheap. But we’re also precise. The FDA audits us every year. We’ve got ISO certs stacked higher than chai cups.

It’s not just about cost. It’s about scale. One plant here makes enough metformin for 100 million people. That’s not greed. That’s engineering.

But I get it-you guys are scared. When the monsoon floods hit last year, shipments delayed. You blamed us. We blamed the weather. No one blamed the 30-day shipping window you built into your system.

Look, I’m not defending corruption or delays. But don’t paint us as villains. We’re the ones showing up at 5 AM, double-checking purity levels, while your labs are still sipping coffee. We’re not the problem. The system is.

And hey-if you want to bring it back to the States? Cool. But don’t cry when your insulin costs $150 a vial. We’ve got 500,000 people working this chain. You wanna replace us? Train 500,000 Americans. Pay them like surgeons. Then we’ll talk.

Alan Lin

January 15, 2026 AT 06:10The structural vulnerabilities in the global pharmaceutical supply chain are not merely logistical anomalies-they are systemic failures of risk governance, exacerbated by decades of neoliberal policy prioritizing shareholder value over public health resilience.

According to the OECD’s 2024 Critical Infrastructure Resilience Index, pharmaceutical supply chains exhibit the lowest redundancy coefficients among all high-consequence sectors, with a mean supplier concentration index of 0.87-far exceeding the 0.6 threshold for critical system fragility.

Furthermore, the cost of capital for domestic API manufacturing in the U.S. is 320% higher than in India due to regulatory arbitrage, environmental compliance burdens, and labor cost differentials, as quantified by Deloitte’s 2025 Capital Allocation Analysis.

Multi-sourcing, while statistically correlated with improved supply continuity (p < 0.01), remains underutilized by firms below the Fortune 500 due to economies of scale constraints and lack of federal subsidy mechanisms.

Therefore, the proposed solution of 'rebalancing' is insufficient without mandatory inventory buffers, public-private API stockpiles, and federally funded micro-factory incubators modeled after the Defense Production Act. The market cannot self-correct this existential risk. Only coordinated state intervention can.

Lethabo Phalafala

January 16, 2026 AT 17:54I lost my dad because they ran out of his heart meds last winter. Not because he didn’t pay. Not because he was lazy. Because the factory in India had a power cut. And no one told anyone until it was too late.

I don’t care about your spreadsheets. I don’t care about your 'efficiency.' I care that my father was gasping for air while CEOs counted their bonuses.

They say 'it’s cheaper.' But what’s the price of a funeral? Of a widow? Of a child who never gets to say goodbye?

It’s not a shortage. It’s a massacre. And we’re all just standing there, scrolling, while people die because someone decided profit mattered more than life.

I’m not mad. I’m heartbroken. And I won’t stop screaming until someone listens.

sam abas

January 17, 2026 AT 04:27ok so like… the whole thing is just a vibe check. like why are we even talking about this? like, i mean, sure, china makes a lot of stuff, but like, have you seen the prices of stuff made in the usa? like, my ibuprofen was $40 last time? i think i’d rather wait 2 weeks for it to come from somewhere else than pay that. like, it’s not like they’re making fake drugs or anything. the fda checks it. right? like, i think people are just panicking because they saw a headline. also, i’m pretty sure the whole '70% of ibuprofen' thing is just a stat that got repeated so much it became true. like, who even counts that? like, are they weighing every pill? idk. also, why are we blaming china? like, we bought it. we asked for it. we didn’t want to pay more. so now we’re mad? weird.

also, i think the real problem is that pharmacies don’t order enough. like, why do they always run out? it’s not the factory. it’s the guy behind the counter who didn’t click 'order more'. just saying.

Nelly Oruko

January 18, 2026 AT 09:05Resilience isn’t a buzzword. It’s a moral obligation.

We optimized for cost. We ignored risk. Now people are dying because we thought efficiency was enough.

It’s not about nationalism. It’s about humanity.

Let’s fix this. Not because it’s profitable. Because it’s right.

Angel Tiestos lopez

January 18, 2026 AT 20:23bro. imagine if your phone charger was made by one company in one country… and one day it just… stopped.

you’d be like ‘wait, i can’t charge my phone?!’

but when it’s your insulin? your blood pressure pill? your antibiotic? you just shrug and say ‘oh well, guess i’ll wait.’

we treat medicine like it’s a disposable app update. not a lifeline.

we need to stop acting like this is normal.

it’s not.

😭

Pankaj Singh

January 18, 2026 AT 21:06India is not a reliable partner. They export drugs like they’re selling street food. No oversight. No accountability. The FDA flags 40% of their facilities for GMP violations. And you’re defending them? Pathetic. This isn’t globalization-it’s exploitation. We’re outsourcing our health to a country with zero transparency, zero ethics, and zero consequences. And you want to call that progress? You’re not a visionary. You’re a fool.

Kimberly Mitchell

January 19, 2026 AT 00:31Let’s be honest: this isn’t about drug shortages. It’s about the collapse of American industrial ambition. We stopped making things because we were too lazy to pay workers a living wage. Now we’re shocked when the supply chain breaks? We created this. We chose convenience over competence. We chose quarterly earnings over human survival. And now we’re surprised when the system fails?

It’s not China’s fault. It’s ours. We traded our sovereignty for a 10% discount on a pill. And now we’re mad when the pill doesn’t arrive?

Wake up. This was never an accident. It was a choice. And we lost.

Angel Molano

January 19, 2026 AT 22:55Stop pretending this is about cost. It’s about control. China owns the supply chain. And they’re not playing fair. They use it as leverage. We’re not victims. We’re naive. And we deserve what’s coming.

Vinaypriy Wane

January 20, 2026 AT 08:00Look-I’ve worked in API logistics for 18 years. I’ve seen factories shut down because of a single broken conveyor belt. I’ve seen customs hold shipments because of a typo on a form. I’ve seen 300 people in a plant work 16-hour days just to meet a deadline.

Yes, we’re cheap. But we’re not careless. We follow the same FDA protocols as U.S. labs. We just don’t get the headlines.

And yes-when a flood hits, or a strike happens, it hurts. But blaming the workers? The country? That’s not justice. That’s scapegoating.

What we need? Better forecasting. More redundancy. Not blame.

And if you think we’re the problem-you’ve never seen what happens when a U.S. plant tries to scale up from zero. It takes five years. And costs $2 billion.

We’re not the enemy. We’re the bridge. Don’t burn it.

Diana Campos Ortiz

January 21, 2026 AT 17:33My aunt takes insulin. She’s 72. She doesn’t know what an API is. She just knows she needs it. Every. Single. Day.

When she missed her refill last year? She cried. Not because she was scared of cost. But because she was scared of dying.

We talk about systems and supply chains like they’re math problems.

But they’re not.

They’re people.

And we’re failing them.

Let’s fix it-for her.

For all of them.

Jesse Ibarra

January 22, 2026 AT 08:35Oh wow. You’re telling me that when you outsource your most vital infrastructure to a communist dictatorship with zero transparency, and then act shocked when they weaponize it? That’s not a tragedy-it’s a farce.

We’ve turned medicine into a commodity traded on the same global exchange as soybeans and lithium. And now we’re surprised people die?

It’s not capitalism. It’s capitalism without a soul.

And you call this progress?

Pathetic. We’re not just outsourcing drugs-we’re outsourcing our dignity.

And we’re too cowardly to admit it.

Randall Little

January 23, 2026 AT 14:10So… if 80% of APIs come from abroad, and 92% of shortages are tied to foreign disruptions… then why is the FDA still approving new drugs without requiring a multi-source supplier requirement? Isn’t that like approving a plane without dual engines?

And why do we keep pretending that ‘nearshoring to Mexico’ is a real solution when 60% of Mexican API inputs still come from China?

It’s not a supply chain. It’s a Russian nesting doll of dependency.

And nobody’s talking about the real bottleneck: the 33% of companies that can’t even hire someone to manage global trade.

So… we’re fixing the wrong thing.

Again.

jefferson fernandes

January 25, 2026 AT 04:45Let’s not forget the people behind the machines.

Every API batch made in India? Made by someone’s mom. Someone’s brother. Someone’s kid who works 12 hours to pay for their sister’s school.

When we call them ‘cheap labor,’ we erase their humanity.

When we blame them for shortages, we ignore the fact that we asked them to carry the weight of our healthcare system.

Let’s fix the system. Not the workers.

Let’s invest in them. Train them. Pay them fairly. And build partnerships-not power plays.

Because resilience isn’t about geography.

It’s about respect.

Alan Lin

January 25, 2026 AT 09:23Thank you for highlighting the human element. The data is clear: supply chain resilience correlates directly with workforce investment, not just geographic diversification. Companies that train local technicians in digital inventory systems and GMP compliance see 47% faster recovery times after disruptions. This isn’t charity-it’s strategic capital allocation. The next generation of pharmaceutical infrastructure must be built on skilled labor, not just subsidies. We need a Marshall Plan for global pharmaceutical workforce development-not just a tariff tweak.