When you pick up a prescription for generic sertraline or metformin, you probably don’t think about how the price got so low. It’s not magic. It’s not charity. It’s the result of a carefully designed system built to let competition do the work - and the government stays out of the way on purpose.

Why Generic Drugs Don’t Need Price Caps

Generic drugs are different from brand-name drugs. Once a patent expires, any qualified manufacturer can make the same medicine. No need to repeat expensive clinical trials. Just prove it works the same way. That’s the whole point of the Abbreviated New Drug Application (ANDA) process, created by the Hatch-Waxman Act in 1984. Since then, the market has been flooded with competitors. And when you have ten companies selling the same pill, prices don’t just drop - they collapse.The data shows it clearly. According to the FDA, within six months of a generic entering the market, prices fall by about 75%. By the time three or more manufacturers are selling it, prices stabilize at just 10-15% of the original brand price. That’s not because the government set a price limit. It’s because the market forced it there.

Even when prices spike - like when a single pharmacy suddenly raised sertraline from $4 to $45 - it’s rare. The FDA’s 2023 Drug Shortage Report found that only 0.3% of generic drugs saw unusual price jumps. Most of the time, when one maker hikes prices, another steps in to undercut them. That’s how free markets work.

What the Government Actually Does

The government doesn’t set prices for generics. It doesn’t need to. Instead, it removes roadblocks. The FDA’s Generic Drug User Fee Amendments (GDUFA), renewed in 2022 with $750 million in industry fees, is a prime example. This program doesn’t control prices. It speeds up approvals. Before GDUFA, it took an average of 18 months to get a generic approved. Now, it’s down to 10 months. In 2023 alone, the FDA approved 1,083 generic drugs - a 35% increase since 2017.That’s not just bureaucracy. It’s economic policy. Faster approvals mean more competitors faster. More competitors mean lower prices. The goal isn’t to cap costs - it’s to keep the race going.

The Federal Trade Commission (FTC) plays a similar role. Instead of fixing prices, it breaks up anti-competitive deals. In 2023, the FTC challenged 37 "pay-for-delay" agreements - where brand-name companies paid generic makers to delay entering the market. These deals kept prices high. When the FTC stops them, prices plummet. One 2023 FTC estimate said cracking down on these deals could save consumers $3.5 billion a year.

Why Medicare Doesn’t Negotiate Generic Prices

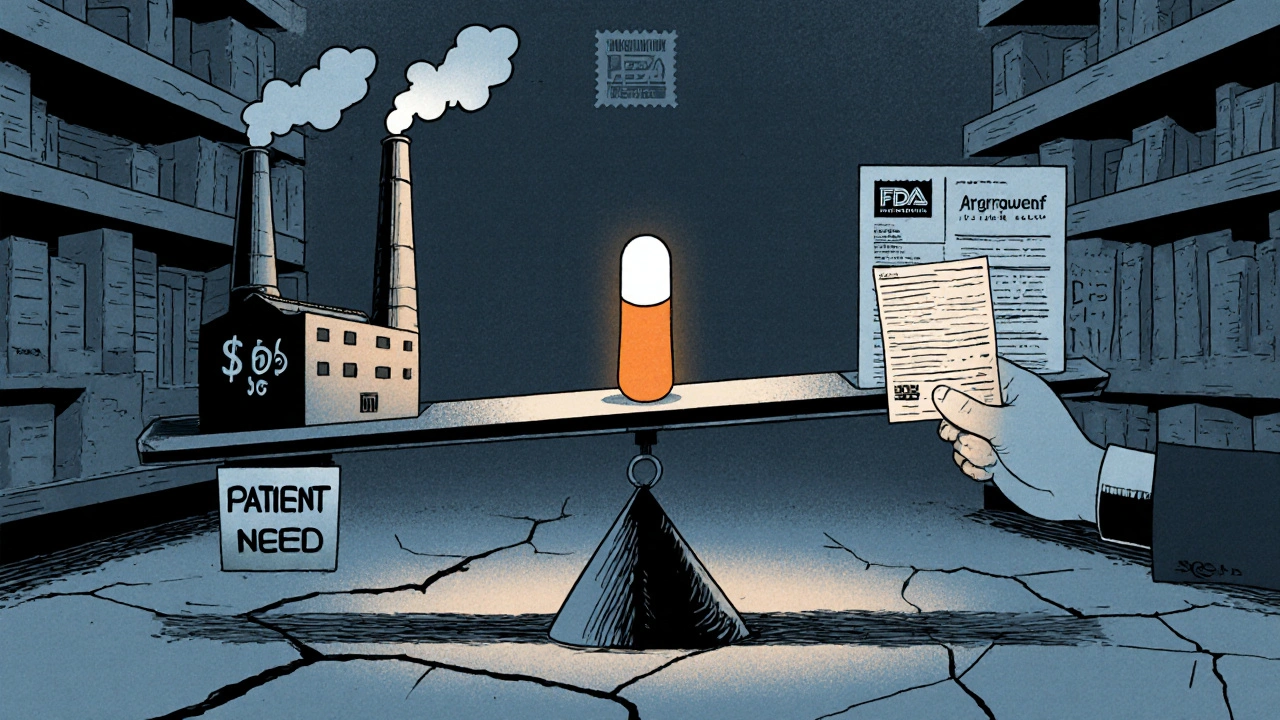

The Inflation Reduction Act of 2022 gave Medicare the power to negotiate prices for some high-cost drugs. But there’s a catch: generic drugs are completely excluded. Why? Because the Department of Health and Human Services (HHS) and the Centers for Medicare & Medicaid Services (CMS) looked at the data and realized: there’s no need.The Medicare Drug Price Negotiation Program targets only "single-source" brand-name drugs with no generic alternatives. That’s why drugs like Ozempic and Wegovy are on the list - they’re expensive, and no one else can make them yet. But generic insulin? Generic statins? Those are already cheap. Negotiating them wouldn’t save much. A Stanford Medicine white paper in January 2024 estimated that negotiating generic prices would save just $1.2 billion a year - compared to $9.5 billion from negotiating brand drugs.

The Congressional Budget Office (CBO) confirmed this in 2023. Applying international price references to generics would cut Medicare spending by only $2.1 billion annually - just 0.4% of total generic spending. Meanwhile, the same policy on brand drugs could save $158 billion. The math is clear: focus on where the money’s being wasted.

The Real Problem: Too Few Competitors

Here’s the twist: the system works great - until it doesn’t. The real issue isn’t high prices. It’s no prices. When only one or two companies make a generic, prices don’t fall. They stay stubbornly high. And sometimes, they disappear entirely.The American Society of Health-System Pharmacists (ASHP) reported in May 2024 that 18% of hospital pharmacists faced shortages of critical generics. Why? Because the price had dropped so low that manufacturers couldn’t cover production costs. One drug might sell for $0.05 a pill. The cost to make it, test it, package it, and ship it? Maybe $0.06. So the company quits. And suddenly, there’s no supply.

This is especially true for complex generics - drugs with tricky formulations, like inhalers, injectables, or topical creams. The FDA found that only 38% of these complex applications met the 10-month approval target in 2023, compared to 94% for simple pills. That’s why the FDA rolled out a new submission template in November 2023. It cut review times by 35% for pilot cases. It’s not about controlling price. It’s about keeping the pipeline full.

How the U.S. Compares to the Rest of the World

The U.S. spends less on generics than other wealthy countries - not because Americans get cheaper drugs, but because there are more makers competing here. The U.S. has an average of 14.7 manufacturers per generic drug. In Europe, it’s 8.2. In Japan, it’s 5.3. More players = lower prices.And yet, the U.S. accounts for 42% of global generic drug volume but only 29% of global value. That means we buy more generics - and pay far less per pill than other countries. That’s not an accident. It’s the result of open market entry, aggressive antitrust enforcement, and fast regulatory approvals.

When the FTC blocked the Teva-Sandoz merger in January 2024, it wasn’t about protecting profits. It was about protecting competition. The merger would have reduced choices for 13 generic drugs. That’s exactly the kind of consolidation that leads to price hikes. The FTC stepped in - not to set prices, but to make sure the market stayed crowded.

What Patients Actually Pay

Real people aren’t paying $100 for their generic blood pressure pills. The 2024 KFF Consumer Survey found that 76% of Medicare Part D users pay $10 or less for generics. For brand-name drugs? Only 28% pay that little. Generic users report 82% satisfaction with affordability. Brand users? Just 41%.On Drugs.com, 87% of 12,450 reviews mentioned "affordable" or "cost-effective" as the top reason they chose generics. Only 5% complained about pricing. The system works for most people - most of the time.

But when a patient’s medication suddenly disappears from the shelf, or their copay jumps from $5 to $45, it’s not because the government failed. It’s because the market broke - and the fix isn’t price control. It’s more competition.

The Future: More Competition, Not More Control

The FDA’s 2024-2026 Generic Drug Implementation Plan is focused on two things: speeding up complex generics and stopping "product hopping" - when brand companies tweak a drug slightly just to extend their patent and block generics. The FTC’s Pharmaceutical Task Force has already brought 12 enforcement actions against anti-competitive behavior since 2023, recovering $1.2 billion for consumers.CMS is also stepping in - not to set prices, but to stop insurers from blocking access. The new Interoperability and Prior Authorization Rule, issued in April 2024, will limit unnecessary prior authorization requirements on generics. That alone could save beneficiaries $420 million a year.

The CBO projects generic prices will keep falling - at 3.5% per year through 2030. Brand drugs? Only 0.8%. That’s not because of a law. It’s because competition is still working.

Government policy on generic drugs isn’t about control. It’s about clearing the path. Let manufacturers in. Let them compete. Watch them drive prices down. And step in only when someone tries to block the race.

That’s the real secret: the cheapest drugs aren’t the ones the government sets a price for. They’re the ones the market is allowed to fix on its own.

Why doesn’t the government set prices for generic drugs like it does for brand-name drugs?

The government doesn’t set prices for generics because competition already does the job. When multiple manufacturers can produce the same drug after a patent expires, prices drop naturally - often by 90% within two years. Programs like Medicare Drug Price Negotiation specifically exclude generics because they’re already affordable. Adding price controls could slow down new manufacturers from entering the market, which would hurt long-term affordability.

Are generic drug prices rising in the U.S.?

Most generic prices are falling or staying flat. The Government Accountability Office found that 97% of generic price increases between 2019 and 2022 were below the inflation rate. In contrast, 46% of brand-name drugs rose faster than inflation. When prices do spike, it’s usually because a manufacturer stopped making the drug due to low profit margins - not because of market manipulation. These cases affect less than 1% of generics.

What’s the difference between a generic drug and a brand-name drug?

A generic drug contains the same active ingredient, dosage, and intended use as the brand-name version. It’s not a copy - it’s an identical medicine, just made by a different company after the original patent expires. Generics don’t need to repeat clinical trials. They only need to prove they work the same way. That’s why they cost 80-85% less. The FDA requires them to meet the same safety and quality standards.

Why do some generic drugs disappear from pharmacies?

Some generics vanish because the price has dropped so low that manufacturers can’t make a profit. If a pill sells for $0.03 but costs $0.04 to produce, ship, and test, the company stops making it. This happens most often with older, low-cost drugs that have many competitors. The FDA and FTC are working to fix this by speeding up approvals for complex generics and cracking down on companies that block competition.

Can I trust that a generic drug works the same as the brand name?

Yes. The FDA requires generics to be bioequivalent - meaning they deliver the same amount of active ingredient into your bloodstream at the same rate as the brand-name drug. Studies show generics perform identically in real-world use. Millions of people take generics every day without issues. The only difference is the price - and sometimes, the shape or color of the pill.

How does the FDA speed up generic approvals?

The FDA uses the Generic Drug User Fee Amendments (GDUFA), which lets drugmakers pay fees to fund faster reviews. Since 2017, this has cut approval times from 18 months to 10 months for most generics. The FDA also created special templates for complex generics and offers expedited review for drugs with few competitors. Real-time tracking tools let manufacturers see where their application stands, reducing delays.

What’s "pay-for-delay" and why does it matter?

"Pay-for-delay" is when a brand-name drug company pays a generic manufacturer to delay launching its cheaper version. These deals keep prices high. The FTC has challenged 37 such agreements in 2023 alone. Ending them saves consumers billions. This isn’t about price control - it’s about stopping illegal collusion that blocks competition.

Do other countries control generic drug prices more than the U.S.?

Yes. Many countries set direct price caps or use international reference pricing. But that often leads to shortages or slower access to new generics. The U.S. relies on competition instead - and as a result, has more generic manufacturers per drug (14.7 on average) than Europe (8.2) or Japan (5.3). That’s why U.S. consumers pay less per pill, even though the U.S. uses more generics overall.

Government policy on generic drugs isn’t about setting prices. It’s about setting the rules so competition can work. And so far, it’s working better than any price cap ever could.

kim pu

November 19, 2025 AT 05:34so like... the gov just sits back and lets the free market do its thang? lol what a fantasy. you think big pharma ain't gamed this system for decades? pay-for-delay? monopolies? they're not just 'competitors' they're oligarchs with lawyers.

Ancel Fortuin

November 19, 2025 AT 05:42you're selling the myth that competition = cheap drugs. what about when there's only one manufacturer left because everyone else got priced out? then you got a monopoly masquerading as 'free market'. the system's rigged, just with more paperwork.

Sarbjit Singh

November 20, 2025 AT 11:44bro this is why i love america 🇺🇸 the system works when left alone. no price caps needed, just let the makers fight. i get my metformin for $3 at walgreens. no drama. just science and capitalism. 😊

Dave Pritchard

November 21, 2025 AT 22:37really appreciate this breakdown. i work in a community pharmacy and see this every day. when 5 companies make the same pill, the price drops like a rock. when one drops out? panic mode. the real villain isn't the government - it's the lack of entry for new players.

malik recoba

November 21, 2025 AT 23:27kinda makes sense but i still get scared when my med changes brand. what if it dont work the same? i mean i trust the fda but... my body remembers the old one. hope they keep making it.

Jeff Hakojarvi

November 23, 2025 AT 04:29the 18% shortage stat is terrifying. i know people who rely on generic insulin and if one plant shuts down? they're screwed. faster approvals help, but we also need incentives for manufacturers to make low-margin drugs. maybe a small subsidy? just enough to keep the lights on.

Timothy Uchechukwu

November 24, 2025 AT 04:44usa thinks it's the best because it has more manufacturers? lol. you have 14.7 makers per drug? great. now tell me how many of them are owned by big pharma subsidiaries? this isn't competition it's a controlled demolition. the fda is part of the machine.

Hannah Blower

November 25, 2025 AT 11:53ah yes, the beautiful myth of the invisible hand. you're ignoring the structural violence of market-driven healthcare. when a patient can't afford their meds because a corporation decided it wasn't profitable enough - that's not a market failure. that's a moral failure dressed in economic jargon. you call it 'competition'. i call it cruelty with a flowchart.

Ronald Stenger

November 27, 2025 AT 02:20the fda approves 1000+ generics a year? sure. but how many of them are just rebranded versions of the same old crap? and who pays for the testing? the taxpayer. the fda is a corporate puppet. they approve fast so pharma can flood the market and drive prices down - then they raise them later when they own the last two players.

Angela J

November 28, 2025 AT 13:43you think this is about competition? it's a psyop. the government lets prices drop so you stop asking why brand drugs cost $1000. they want you to think generics are 'the solution' so you don't notice they're still charging you for the same system that made the brand drugs unaffordable in the first place. they're playing you.

Gregory Gonzalez

November 29, 2025 AT 06:44the only thing more naive than believing in free-market drug pricing is believing people actually read this post. congrats on writing a 2000-word op-ed that sounds like a congressional briefing. the average person just wants to know if their pill will work and if they can afford it. you overthought it.